If you’re an American living abroad, your tax obligations are a little bit more complicated than most other nationalities.

You may assume that if you’re not earning money in the United States, you have no obligation to file a tax return each year. Unfortunately, this couldn’t be further from the truth.

Luckily, Taxes for Expats can help get you sorted. The service will do all the hard work for you so you can make sure you meet all your tax obligations and don’t end up with a hefty bill (or fines).

This isn’t just a digital solution. These are human experts who have been working in the industry for at least 10 years (half of them have more than 20 years of industry experience). They’re also well-versed in US tax law, and since work is completed in the United States by US citizens, you can rest assured that your information is in safe hands.

Taxes for Expats double checks all of your data. At least two professionals check your tax return to make sure the best solutions are found for you. One of the great things about this service? The pricing. Many people may be hesitant to try a service like this for the first time since no one wants to feel like they’re at risk of getting a big bill. But with Taxes for Expats, all of the fees are agreed to beforehand, and you can easily see how much you’ll be paying for the service. You may also want to check out the FBAR form which is often overlooked. Taxes for Expats only charge $75 for this form.

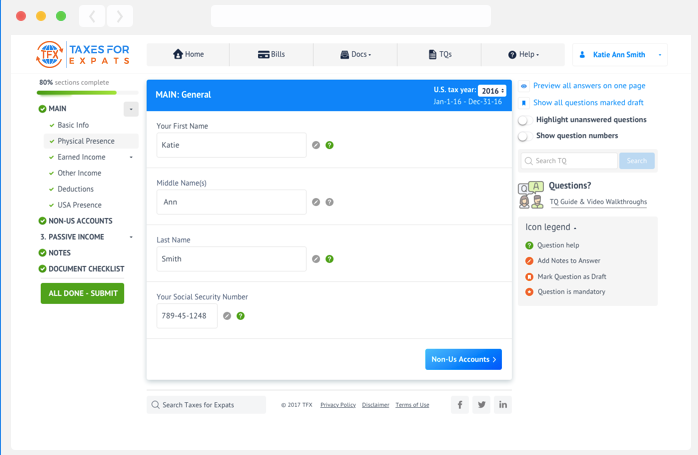

One of the things that make the system so easy to use? The client portal. Check it out below:

As you can see it’s super user-friendly and intuitive.

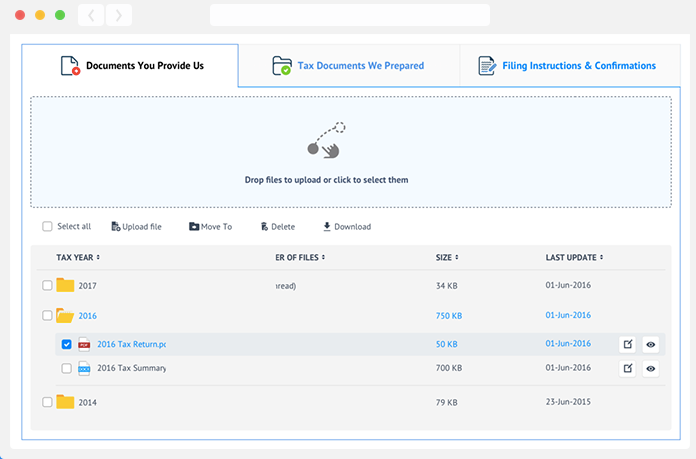

In this day and age, most of us are also concerned about who our data is being shared with. Taxes for Expats keeps all data strictly to itself- it doesn’t share any of it with third parties- even on the cloud.

When you’re completing the questionnaire, you’ll find it super easy to do, with no Excel spreadsheets or Word files making life difficult.

Taxes for Expats also have excellent support, including live chat and 18-hour phone support. If you’d like to get started, you can register on the Taxes for Expats website to get started. You’ll just complete a questionnaire and sign a letter. Once the team have completed your tax return you’ll pay and then review the return.

If you’re an American living abroad, you really can’t go wrong with a service like Taxes for Expats. Make life easy for yourself and use this service next time you need to file your taxes.